Financial Tools: Essential Resources to Improve Your Money Management in 2025

Managing your finances effectively is one of the most important steps toward achieving stability, building credit, and reaching long-term goals.

This Financial Tools section provides easy-to-use calculators, trackers, and resources designed to help you make smarter financial decisions every day.

Whether you want to improve your credit score, plan your budget, compare credit cards, or track your debt, these tools will guide you toward better financial health.

1. Credit Score Simulator

A credit score simulator helps you predict how certain actions might affect your credit score.

You can test scenarios like:

Paying off credit card balances

Increasing credit limits

Opening or closing accounts

Removing collections

Paying bills on time

This tool shows you how your score may rise or fall—helping you make more informed decisions.

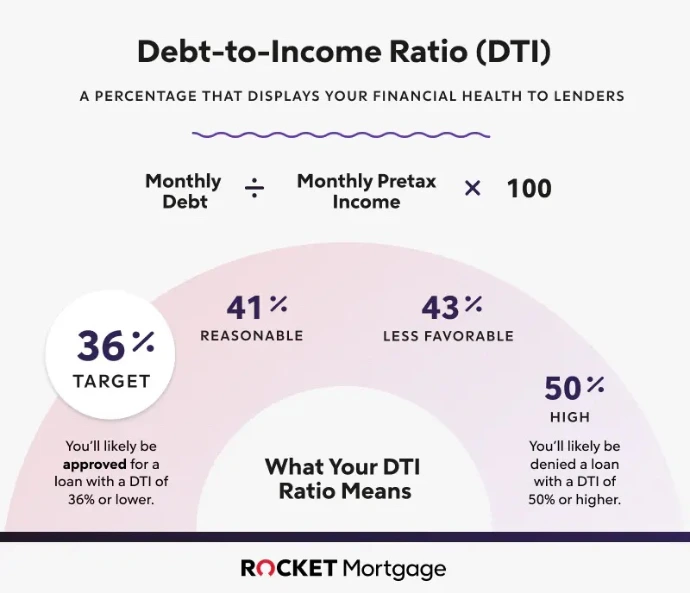

2. Loan Payment Calculator

This calculator helps you estimate monthly payments for:

Auto loans

Personal loans

Student loans

Debt consolidation loans

Just enter:

Loan amount

Interest rate

Loan term

The tool reveals your payment schedule, total interest, and total cost.

3. Credit Card Comparison Tool

With so many cards available, choosing the right one can be overwhelming.

This tool lets you compare cards by:

Rewards

Annual fees

APR

Balance transfer offers

Credit requirements

Ideal for picking the best credit card for your needs.

4. Budget Planner & Monthly Expense Tracker

A financial budget tool helps you track where your money goes each month.

Features include:

Income tracking

Fixed and variable expenses

Savings goals

Automatic balance updates

Monthly spending reports

A clear budget is the first step toward financial control.

5. Debt Payoff Calculator (Snowball & Avalanche Method)

This tool helps you create a plan to eliminate debt faster using:

Snowball method (smallest debt first)

Avalanche method (highest interest first)

It shows:

Payoff dates

Total interest saved

Optimal payment strategy

Perfect for organizing multiple debts and reducing stress.

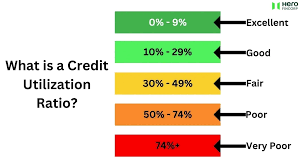

6. Credit Utilization Tracker

Credit utilization affects 30% of your credit score.

This tool helps you track:

Current balances

Credit limits

Utilization per card

Total utilization percentage

It helps you stay under the recommended 30%, or even the ideal 10%.

7. Savings Goal Calculator

Plan and track financial goals such as:

Emergency fund

Car purchase

Vacation

Home down payment

Enter your target amount and timeline, and the tool calculates how much you need to save each month.

8. Income vs. Expense Analyzer

This tool helps you understand if you're living below, within, or above your means.

You'll be able to see:

Total monthly income

Total monthly spending

Surplus or deficit

Suggestions to optimize your budget

A simple but powerful way to regain financial balance.

9. Credit Report Checklist

This downloadable checklist shows you what to monitor:

Personal information

Open accounts

Payment history

Hard inquiries

Collections

Errors or suspicious activity

Using this tool monthly helps protect your credit score.

10. APR & Interest Cost Calculator

Before applying for any card or loan, this tool helps you see:

True cost of borrowing

Annual percentage rate

Monthly interest

Long-term financial impact

Helping you avoid expensive mistakes.

Why These Tools Matter

Financial tools give you:

Clarity

Control

Better decision-making

Faster credit improvement

Reduced debt

Smarter spending habits

The more informed you are, the stronger your financial future becomes.

Conclusion

The Financial Tools section is designed to empower you with the knowledge and resources needed to make better money decisions every day.

Use these tools regularly to improve your credit score, optimize your budget, choose the best financial products, and achieve your long-term goals.

Call to Action

Ready to take control of your finances?

Explore each tool and start building a stronger financial future today.